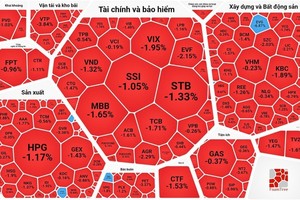

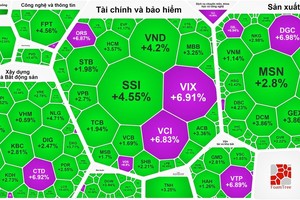

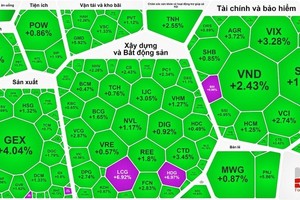

Stock groups that had positive impacts on the VN-Index today were MSN with an increase of 1.9 percent, GAS with 1.9 percent, VCB with 2.7 percent, SSI with 2.5 percent, VRE with 3.8 percent, CTG with 2.3 percent, BID with 2.2 percent, FPT with 0.8 percent, and VNM with 0.6 percent. With support from large-cap stocks, the VN-Index unexpectedly rebounded successfully in the ATC matching session.

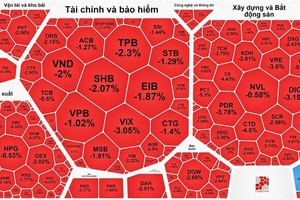

Specifically, the VN-Index ended the last trading session of October with a slight increase of 0.58 points to 1,027.94 points. However, the number of winners merely accounted for over a third of that of losers, with 138 advancers against 317 decliners.

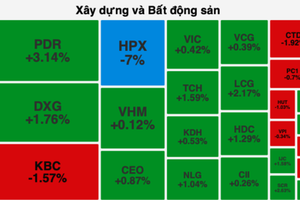

Noticeably, the list of stocks that fell to the floor consisted of many steel stocks. This stock group was under heavy selling pressure after announcing quite negative third-quarter business results, with HPG being the leader, followed by NKG, HSG, SMC, TLH, and POM.

In the trading session today, HPG often faced the situation of a blank list of buyers. Sometimes, its excess selling volume reached nearly 20 million shares. At the end of the session, this stock code dropped to the floor by 7 percent to VND15,650 per share.

Despite being sold off, HPG became a stock in the VN30 basket with a huge trading volume of nearly 66.3 million shares, of which foreign investors net sold more than 20 million shares.

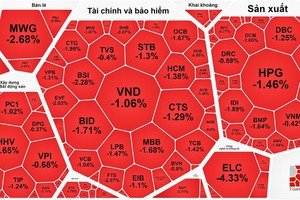

The stock code VND continued to be traded with a volume of more than 25 million shares, followed by HSG with 21.4 million shares, SSI with 20.5 million shares, DIG with 19 million shares, STB with 16.7 million shares, PVD with 15.5 million shares, HAG with 15.3 million shares, and LPB with 15 million shares.

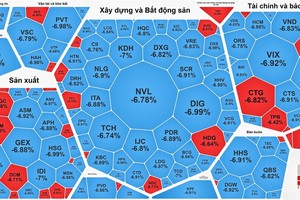

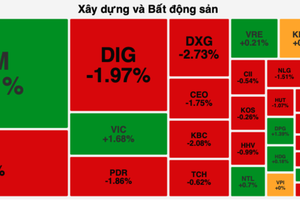

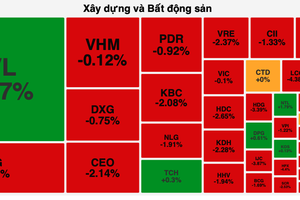

The fact that steel stocks massively hit the floor harmed the real estate and construction sectors. Notable losers were DIG with a decrease of 6.8 percent, NHA with 6.7 percent, PTL with 6.2 percent, DRH with 6.8 percent, TDH with 5.7 percent, TDC with 6.7 percent, ITC with 5.3 percent, HBC with 6 percent, LDG with 4.5 percent, CTD with 4.3 percent, ITA with 5.1 percent, and NVL with 3.4 percent.

Market liquidity dropped to only VND11.42 trillion, down nearly VND2 trillion compared to the trading session last weekend. On all three exchanges, the total trading value reached roughly VND12.39 trillion.