Vietinbank's transaction office during working hours. The bank shares fell 7 percent, the biggest daily losses, yesterday. — Photo courtesy of Vietinbank

Vietinbank's transaction office during working hours. The bank shares fell 7 percent, the biggest daily losses, yesterday. — Photo courtesy of Vietinbank The market benchmark VN-Index on the Ho Chi Minh Stock Exchange (HoSE) lost 55.8 points, or 4.29 percent, to close Monday's trade at 1,243.51 points. The index finished last week at 1,299.31 points, but still declined 3.6 percent for the week.

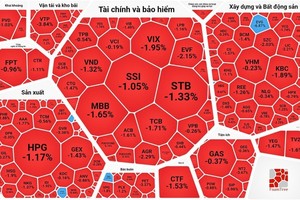

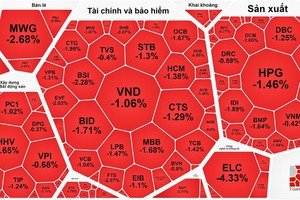

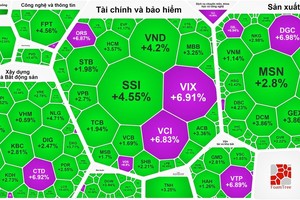

The market’s breadth was negative as 346 stocks plunged while 50 stocks rose. The liquidity was high with over 731 million shares being traded on the southern bourse, worth more than VND21.8 trillion (US$947 million).

The 30 biggest stocks tracker VN30-Index witnessed a big drop of 63.9 points, or 4.44 percent, to 1,374.15 points. Twenty-nine of these stocks in the VN30 basket slid with four stocks posting maximum daily losses, while only one stock climbed.

On the Hanoi Stock Exchanges (HNX), the HNX-Index also inched down 5.1 percent to 292.06 points.

During the session, over 130.1 million shares were traded on HNX, worth nearly VND3 trillion.

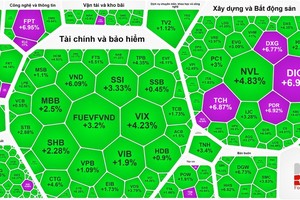

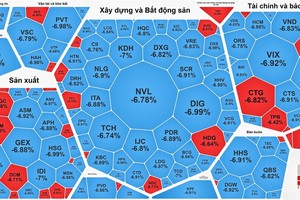

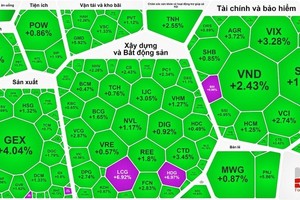

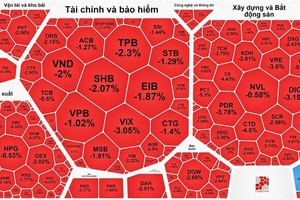

Selling pressure weighed on the whole market since the morning session opened. Stocks from all sectors, especially banking, recorded big losses.

The market was also affected after Hanoi and 16 other provinces started applying stricter restrictions to prevent the ongoing fourth wave of Covid-19 yesterday.

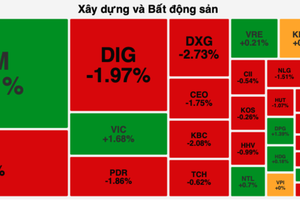

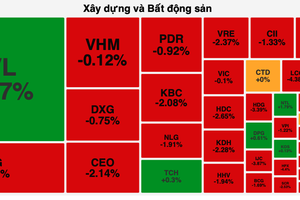

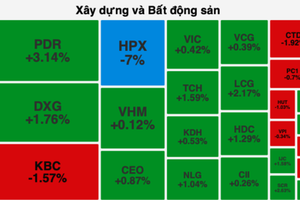

In the top five stocks influencing the market’s downward trend, Vietcombank (VCB) lost the most in market capitalization, down 5.37 percent. It was followed by Vinhomes JSC (VHM), Techcombank (TCB) and JSC Bank for Investment and Development Of Vietnam (BIDV, BID) with the two bank stocks losing more than 6.7 percent.

Many stocks, mostly in the banking field, even hit the maximum daily loss of 7 percent yesterday, including VPBank (VPB), Vietinbank (CTG), Vietnam International Commercial Joint Stock Bank (VIB), Tien Phong Commercial Joint Stock Bank (TPB) and Vietnam Rubber Group (GVR).

Others from utilities, information technology (IT), transportation and logistics, and retail group also witnessed poor performance.

However, there were still some stocks running contrary to the market’s general trend, up nearly 1 percent to more than 2 percent. These stocks included Ba Ria - Vung Tau House Development JSC (HDC), DHG Pharmaceutical JSC (DHG) and Khang Dien House Trading and Investment JSC (KDH), on positive business results.

Analysts from Saigon-Hanoi Securities Joint Stock Company (SHS) said that the market was likely to continue to adjust to lower price ranges this week to seek a return of demand.

Bao Viet Securities Company said that the benchmark will maybe test the resistance zone of 1,333 - 1,348 points in the short-term. And the second quarter financial results will be a factor supporting stock groups at the moment.

Meanwhile, foreign investors were net sellers on the southern market, with a net value of VND101.44 billion, but net bought a value of VND15.43 billion on HNX.